Pay Frequency Expansion

At SimplePay, we realise the importance of balancing simplicity with functionality that allows you to customise the system for your payroll needs. That’s why we’ve expanded our pay frequency settings to give you more flexibility to customise payment dates.

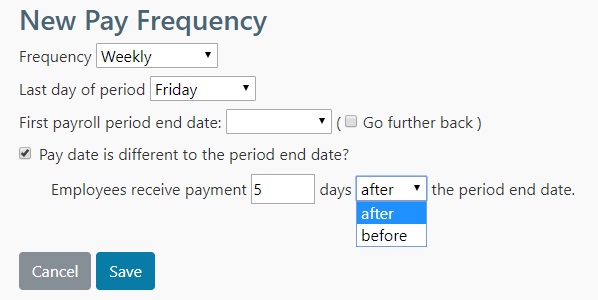

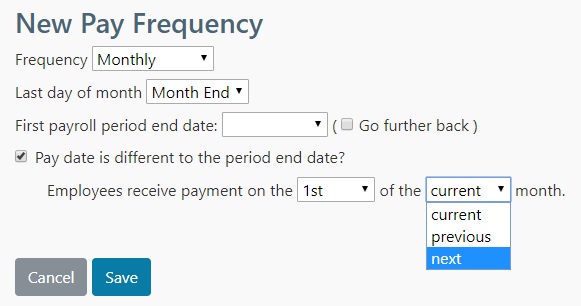

As most employers align their pay frequency end date with the payment date to employees, SimplePay based all calculations on the payslip end date, which you could customise for your business. The extension of the pay frequencies functionality caters for employers where there are significant differences between the payslip end date and the payment date (for example, an employee is only paid one week after their payslip date). You can now set a payment date that falls in the current, previous or following month (for monthly pay frequencies) or set a payment date relative to the payslip end date (for other pay frequencies). You can also edit the payment date for individual payslips.

This increased flexibility to tailor the system allows you to better align the tax, tax credits, tax cut-offs and year-to-date total calculations with your business practices. The payment date will also be used to determine in which submission and tax year the payslip will be included.

To specify a payment date:

- Go to Settings > Pay Frequencies

- Select the pay frequency to edit or add a new pay frequency. Editing pay frequencies will impact tax calculations, so this should be done with caution.

- Select the checkbox Pay date is different to the period end date?

- For monthly pay frequencies, specify the date of the payment in the current, previous or next month

- For other pay frequencies, specify the relative payment date

- Click Save when you are satisfied with the pay frequency set up.

For more information on pay frequencies, head over to our help page here.

Team SimplePay